Weekly Market Summary

Andrew Silver

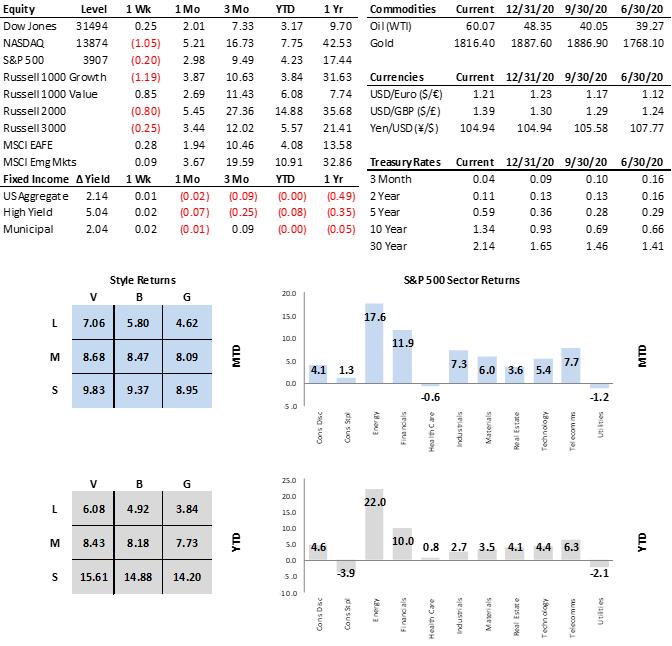

The holiday shortened week saw encouraging economic prospects translate to a textbook, pro-cyclical moves across markets as evidenced by rallies in cyclical areas of the stock market, commodities, and bond yields. The economic calendar provided a boost with robust retail sales, continued strength in the housing market, and further evidence of a strong manufacturing sector. All major indices set new record highs on Tuesday, but the S&P 500 finished the week down 0.71% due to heavy weights in technology and healthcare which struggled. Financials, materials, industrials, and energy were all positive (as was the equal weight S&P). Bond yields moved decisively higher and steeper, translating to softness in higher valuation and rate sensitive areas. The USD traded lower in step with its counter-cyclical nature while commodities moved higher (ex/oil).

Market Indicators

- One year ago last Friday, the S&P 500 closed at a record high, then went on to lose 33% over the next five weeks.

- Wal-Mart’s earnings call marked the unofficial end of what was an encouraging earnings season where, despite record beat rates, stock price reactions were one of the weakest on record.

- Significant debate continued surrounding what level of yields will begin to prove troublesome for equities. Market internals remain encouraging at this time. A sustained move higher in yields with a simultaneous confirmation of a shift in market internals remain a key focus.

- Developed market international stocks were up last week while emerging markets were down slightly. Both outperformed broad U.S. markets. Yield curve steepening has varied globally.

- Inflation is coming in the near term due to base effects, clear evidence of bottlenecks, and some order of pipeline effect. 5yr forward breakevens have recovered but are still not overly high.

- Fed speakers (ten last week) were busy pre-excusing the coming uptick in inflation given their intent on maintaining balance sheet operations and policy rates for the time being.

- S. policy developments last week included an immigration reform proposal, a walk back on prospects for student loan debt cancellation, extending foreclosure moratoriums through June 30th, officially rejoining the Paris Agreement, and the beginning of addressing tax increases.

- The stimulus package is expected to pass the House this week, followed by the Senate in early March, and POTUS signing into law mid/late March.

- The Atlanta Fed GDPNow Q1 estimate surged to 9.5% after factoring in the economic data last week (retail sales, industrial production, regional surveys).

- Former ECB President Mario Draghi officially replaced Giuseppe Conte as Italy’s new PM.

- Bloomberg reported Pfizer and BioNTech SE vaccines “appeared to stop the vast majority of recipients in Israel becoming infected, providing the first real-world indication that the immunization will curb the transmission of the coronavirus.”

Economic Release Highlights

- January Retail Sales crushed consensus forecast (5.3% vs 1.1%) on the headline number as well as all sub-index metrics including ex-vehicles & gas (6.1% vs 0.5%) and control (6.1% vs 0.9%).

- January Industrial Production came in at a very solid 0.9%, beating consensus of 0.5%. Both manufacturing output and capacity utilization also came in higher than forecasted.

- February Housing Market Index (84 vs 83) was in line with estimates, continuing to reflect extraordinary positive homebuilder assessments of current housing market conditions.

- January Housing Starts (1.580M) and Permits (1.881M) missed and beat forecasts respectively after strong beats the prior two months.

- February flash PMIs (M,S,C) showed near universal strength and improvement across the manufacturing sector but continued weakness in services (CoVid) with the U.S. continuing to act as a bright spot – U.S. (58.5, 58.9, 58.8), EU (57.7, 44.7, 48.1), and Japan (50.6, 45.8, 47.6).

- The February Empire State Manufacturing Index doubled consensus estimates, registering 12.1 vs a 5.7 forecast.

- The February Philly Fed Manufacturing Index came in strong at 23.1 versus forecast of 20.0.

The Numbers